What You Will Need :

√ SSN or Individual Tax Identification Number (ITIN)

√ Your filing status

√ Your exact refund amount

IRS CALL 800-829-1041

TO FIND OUT IF YOU HAVE A DEBT WITH THE IRS CALL 800-304-3107

What You Will Need :

√ SSN or Individual Tax Identification Number (ITIN)

√ Your filing status

√ Your exact refund amount

What You Will Need

:

√ SSN or Individual Tax Identification Number (ITIN)

√ Date of birth

√ Zip Code

What You Need :

√ SSN or Individual Tax Identification Number (ITIN)

√ Date of birth

√ Mailing address from your latest tax return

Pay Your Taxes Now :

Pay with your bank account for free, or choose an approved payment processor to pay by credit or debit card for a fee. Also available at the IRS2Go app.

We're an ambitious workaholic, but apart from that, pretty simple persons.

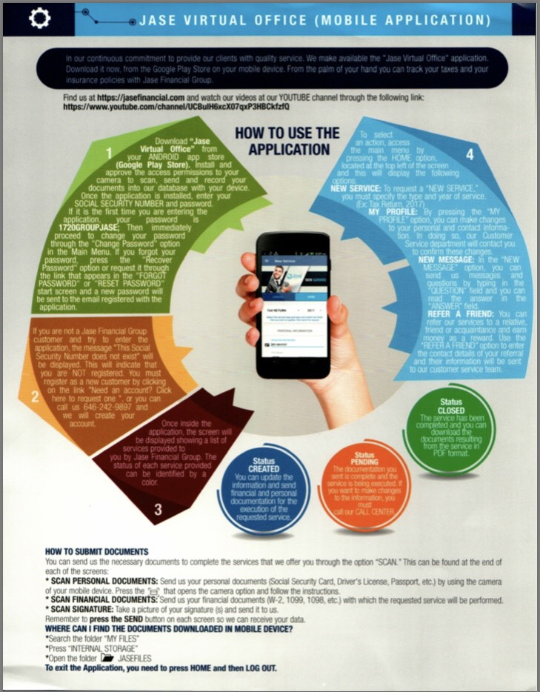

For years, Jase Financial Group has been providing quality, personalized financial guidance to local individuals and businesses. Our expertise ranges from basic tax management and accounting services to more in-depth services such as audits, financial statements, and financial planning.

Jase Financial Group is one of the leading firms in and throughout the area. By combining our expertise, experience and the team mentality of our staff, we assure that every client receives the close analysis and attention they deserve. Our dedication to high standards, hiring of seasoned tax professionals, and work ethic is the reason our client base returns year after year.

Our mission is to help clients maintain financial viability in the present, while taking a proactive approach to achieve future goals. This requires open communication to reach an understanding of our clients' needs through research and sound analysis. Jase Financial Group is dedicated to meeting these goals with high standards of excellence and professionalism. We have been a staple of the area's business community for years, and pride ourselves on the level of esteem we have earned.

Our dedication to hard work has earned the respect of the business and financial community in and around the area. We believe this to be a direct derivative of our talent and responsiveness to our client base. Whether you are a current or prospective client, rest assured that individuals and businesses who choose Jase Financial Group receive competent and timely advice.

From the months of May to December:

Monday Through Friday 10 AM A 5 PM

During Tax Season (January til April)

Monday Through Friday 9 AM A 7PM

Saturdays 10AM To 5PM

Sundays 12PM To 4PM

Jase Financial Group provides a wide range of services to individuals and businesses in a variety of industries. At Jase Financial Group, we strive to meet each client's specific needs in planning for the future and achieving their goals in an ever-changing financial and regulatory environment.

We guide our clients through a full range of tax planning and preparation decisions with strategies that minimize your tax liabilities, maximize your cash flow and keep you on track to your financial goals. Our expertise, experience, analysis and thorough research allow us to optimize financial opportunities to be found in existing as well as recently altered tax laws. We are knowledgeable and up to date on the tax laws and can make sense of your receipts, bills and notices.

We strive to provide accurate bookkeeping services that handles all your tedious accounting tasks so you can concentrate on running your business. let's us do the hard work as:

* Sales Tax.

* Create LLC, Corporations.

* Payroll.

* Liquor license.

* Generate 1099 and W2.

* Review Commercial Lease.

* Workers Compensation Audit.

▪ Tax Management Services ▪ Bookkeeping/Write-up

▪ Amendment Tax Return. ▪ Quick Books Accounting Help and Assistance

▪ Tax Preparation ▪ Commercial Lease Review.

▪ Commercial Taxes ▪ Notary.

▪ IRS Representation ▪ Translations.

▪ Financial Planning ▪ Health Department Representation.

▪ Payroll Services ▪ Accounting Services

State Refund Status Hotline General Information

Alaska N/A 1-907-465-2350

Alabama 1-334-353-2540 1-334-242-1170

Arizona 1-877-542-2281 1-602-255-3381

Arkansas 1-877-727-3468 1-501-682-1100

1-800-882-9275

California 1-800-338-0505 1-800-852-5711

Colorado 1-303-238-3278 1-303-238-7378

Connecticut 1-800-382-9463 1-860-297-5962

Delaware 1-800-292-7826 1-302-577-8200

DC 1-202-727-4829 1-202-727-4829

Florida 1-850-488-8937 1-800-352-3671

George 1-404-417-4460 1-404-417-4477

1-404-417-4480

Hawaii 1-800-222-3229 1-808-587-4242

Idaho 1-888-228-5770 1-800-972-7660

Illinois 1-800-732-8866 1-800-732-8866

Indiana 1-317-233-4018 1-317-232-2240

Iowa 1-800-572-3944 1-800-367-3388

1-515-281-4966

Kansas 1-800-894-0318 1-785-368-8222

State Refund Status Hotline General Information

Kentucky 1-502-564-1600 1-502-564-4581

Louisiana 1-888-829-3071 1-225-219-0102

Maine 1-207-626-8475

Maryland 1-410-260-7701 1-410-260-7980

1-800-218-8160 1-800-637-2937

Massachusetts 1-617-887-6367 1-800-392-6089

Michigan 1-800-827-4000 1-517-373-3200

Minnesota 1-651-296-4444 1-651-296-3781

1-800-657-3676 1-800-652-9094

Mississippi 1-601-923-7801 1-601-923-7000

Missouri 1-573-529-8299 1-573-751-3505

1-573-751-7200

Montana 1-866-859-2254 1-406-444-6642

1-866-444-6900

Nebraska 1-800-742-7474 1-800-471-5729

Nevada N/A 1-775-684-2000

New Hampshire 1-603-271-2191 1-603-271-2191

New Jersey 1-800-323-4400 1-609-292-6400

1-609-826-4400

New Mexico 1-505-827-0827 1-505-827-0822

New York 1-518-457-5149 1-518-457-5181

1-800-443-3200

State Refund Status Hotline General Information

North Carolina 1-877-252-4052 1-877-252-3052

North Dakota 1-701-328-1242 1-701-328-7088

Ohio 1-800-282-1780

Oklahoma 1-800-522-8165 1-800-522-8165

Oregon 1-800-356-4222 1-503-378-4988

Pennsylvania 1-888-788-2937 1-717-787-8201

Rhode Island 1-401-574-8829

South Carolina 1-803-898-5300 1-803-898-5709

South Dakota N/A 1-605-773-3311

Tennessee 1-800-342-1003

Texas N/A N/A

Utah 1-801-297-2200 1-800-662-4335

Vermont 1-866-828-2865 1-802-828-2865

Virginia 1-804-367-2486 1-804-367-8031

Washington 1-800-647-7706

West Virginia 1-304-344-2068 1-304-558-3333

1-800-422-2075 1-800-982-8297

Wisconsin 1-866-947-7363 1-608-266-2772

Get in touch and we’ll get back to you as soon as we can. We look forward to hearing from you!.